Investing in Amazon.com – 955 Billion Dollars Later…

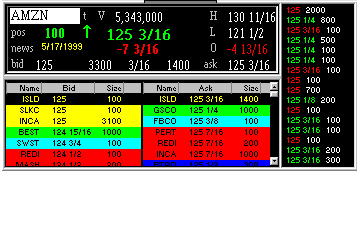

I found this gem going through some old photos and screen shots on a backup drive. Wow, Time flies!!! This screen shot was taken in May 1999 when Amazon’s market cap was only $21 billion.

I bought 100 shares of Amazon at 122.75 (shown in the screen capture). Four months later, Amazon stock would split 2-for-1, which is the equivalent of buying 200 shares of Amazon.com at $61.38

Amazon stock has demonstrated amazing growth in 20 years. Currently, Morgan Stanly has an overweight rating with $2300 price target. Cowen has an overweight rating with $2500 price target. Davidson has a buy rating with $2550 Price target (a $1.253 Trillion market cap).

The questions many of us are asking are, will Amazon continue to dominate? Will Amazon become and remain the largest (market capitalization wise) company in the world?

Many who hear the story of Amazon’s stock going up from $1.50 to $2050 (IPO price, split adjusted) don’t realize that Amazon had a tough period in which it declined 95% in 30 months. Amazon stock went down from $110 to $5.51. It certainly wasn’t an easy ride to stomach, even for the biggest Amazon bulls.

Not many CEOs would get to keep their job when their stock declines 95% in 30 months, but Jeff Bezos didn’t only keep his job, he also became the richest man in the world. That is truly remarkable.

In addition to the popularity of investing in Amazon, Amazon stock (AMZN) is also one of the most popular stocks for daytrading, swing trading and options trading as well. Amazon weekly options have great liquidity and provide opportunities for various options trading strategies such as Bull Spread, Bear Spread, Iron Condor, and Butterfly.